Labuan Companies

A Federal Territory of Malaysia

The only offshore jurisdiction of Malaysia, situated approximately

8km off the north-west coast of Borneo, adjacent to the Malaysian state of Sabah

92 square kilometers in area with a population of approximately 90,000 people

Malaysia's only International Business and Financial Centre with its own regulator and tax regime (1990)

Malaysia most established duty-free island

Labuan Companies can engage in a range of activities:

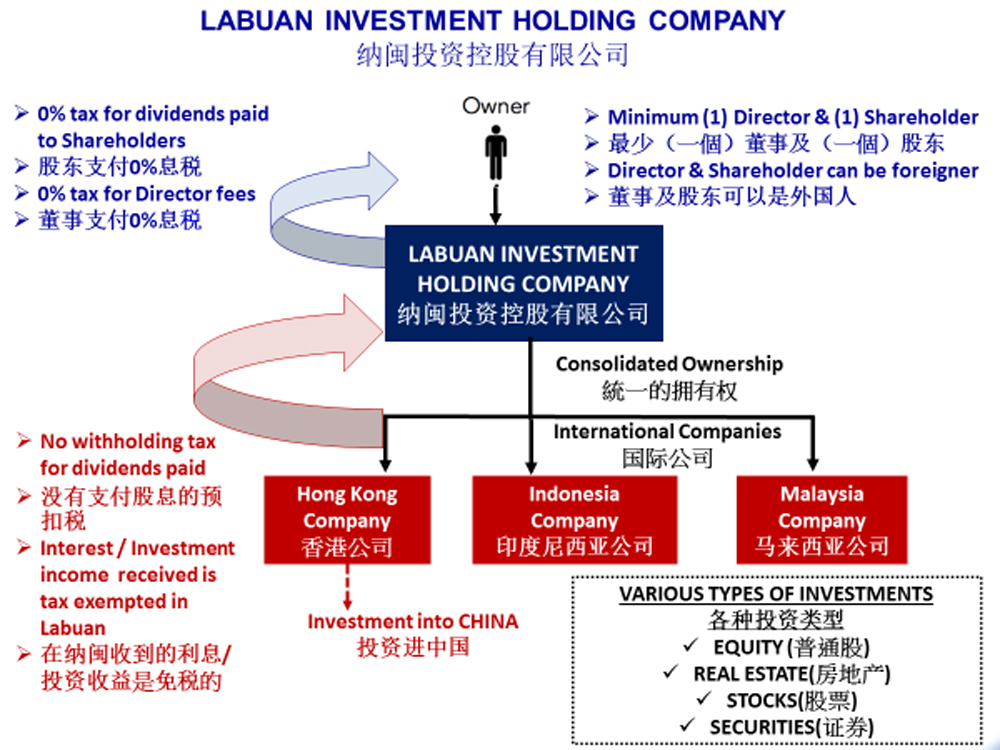

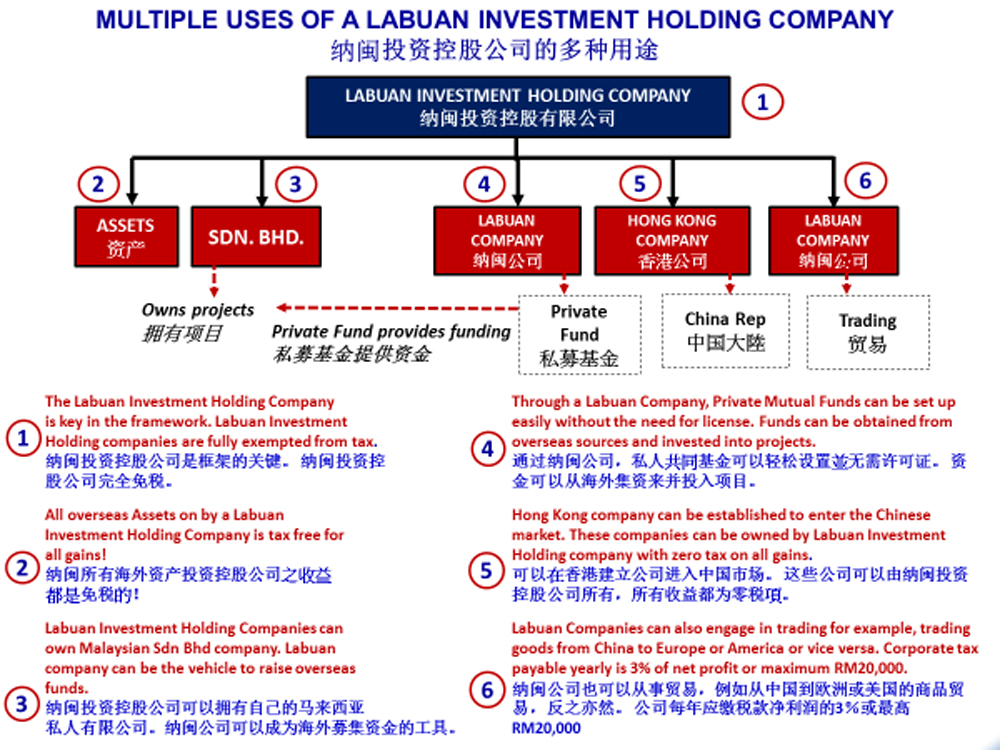

Investment holding companies

International trading companies

International shipping companies

Intellectual property licensing companies

Mutual fund establishment

Banking and financial institutions*

Leasing and bareboat chartering companies*

Insurance, reinsurance, captive insurance, protected cell companies, takaful and retakaful activities*

Fund management*

Investment advisory / securities licensee / money broking*

* Requires license from Labuan Financial Services Authority

Key features of a Labuan Company

0% tax on non-trading activity (investments). No further tax on dividends remitted back to home countries

3% of net audited profits or RM20,000 flat tax on trading activity

0% Withholding tax: Dividend, royalty, lease rental, interest, technical or management Fee

No capital gains tax, estate or inheritance tax

0% indirect tax (such as Sales Tax, Service Tax, GST, VAT and Custom Duty)

0% Personal Income Tax for Non-Malaysian Director

0% Stamp Duty – Labuan is a free tax port

No foreign ownership limitations

Eligible to open bank account in multiple currencies

No foreign exchange control rules

Business confidentiality. Shareholders' & Directors' information are not available for search

Access to Malaysian Double Tax Treaties (DTA) with more than 70 Countries

Capital denomination in any currency, except Malaysian ringgit

Setting up a Labuan Company

The Labuan Companies Act 1990 ("LCA") requires a Labuan company to employ the

services of a trust company to act as its incorporation agent.

The services offered by a trust company include, but are not limited to, the following:

Provides the registered office and resident secretary

Performs the secretarial duties of the Labuan company including

lodgement of any documents required under the LCA

Makes available any of its trust officers for appointment as resident director and resident secretary

Registering a company name

New company names cannot be similar or the same as the names of existing companies registered in Labuan. The words "bank",

"finance", "fund", "trust" or any other license-linked-word (i.e. insurance) should be avoided. The exception is if the company will

undertake these specific business activities, most of which requires a corresponding business licenses.

A Labuan company shall have, as part of its name:

- - the word "Corporation" or the word "Incorporated" or the abbreviation "Corp." or "Inc.",

- - the word "Limited" or the abbreviation "Ltd.",

- - the words "Public Limited Company" or the abbreviation "P.L.C.",

- - the words "Societe Anonyme" or "Sociedad Anonima" or the abbreviation "S.A.",

- - the words "Aktiengesellschaft" or the abbreviation "A.G.",

- - the words "Naamloze Vennootschap" or the abbreviation "N.V.",

- - the words "Perseroan Terbatas" or the abbreviation "P.T.", or

- - in romanised characters, any word or words in the national language of any country which connote a joint stock company limited by shares, or any abbreviation thereof,

- - the word "(L)" as part of its name, and

- - the word "Berhad" or the abbreviation "Bhd." but where the word "Berhad" or the abbreviation "Bhd." is used as part of the name of the Labuan company; the Labuan company should also have the word "(L)" as part of its name.

Share Capital

There is no minimum share capital requirement. However, our standard

companies will have a minimum of USD1 paid-up capital, comprising one issued ordinary share.

Shareholders may either be individuals or corporations.

Share capital can be held in any currency other than Malaysian Ringgit.

Directors

Labuan companies must have at least one director, either a corporation or an individual. The director may be a non-resident or resident of Malaysia.

An officer of a trust company may be the resident director of the Labuan company. Particulars of the directors must be filed with the Labuan Financial Services Authority (FSA).

Company Secretary

The company must have a resident secretary (individual or corporate), which must be appointed from a trust company.

Particulars of the company secretary must be filed with the Labuan Financial Services Authority.

Registered office

All Labuan companies must have a registered office in Labuan, which must be the principle office of a Labuan trust company.

Annual Fees

An annual fee of RM2,600 / USD800 is payable on or before the anniversary

of incorporation to renew the registration of the company for a further 12 months period.

Tax Returns

Annual tax returns must be filed to the Inland Revenue Board.

Labuan companies engaged in Labuan trading activities are subject to

corporate profit tax, which will be levied at 3% on chargeable net profit as per the audited financial statements.

For companies engaged in Labuan non-trading activities, no tax is payable on income earned through these activities. In such cases, only a zero-tax return is filed.

- Alternatively, a company can elect to pay a flat tax of RM20,000.

Taxation of Labuan Companies

Labuan trading activities include banking, insurance, trading, management,

licensing, shipping operations or any other activities that do not fall within

the definition of non-trading Labuan companies conducting Labuan trading activities:

Labuan non-trading activities can include the holding of securities, stock, shares, loans, deposits or any other properties by a Labuan company on its own behalf. Labuan companies conducting non-trading activities:

- No tax is payable on profit earned by a Labuan Company when it is engaged in Labuan non-trading

In cases where a Labuan company is involved in trading and non-trading activities,

it will be taxed as if it were undertaking trading

- - A rate of 3% on chargeable profit (i.e. net profit as reflected in the audited accounts), or

- - A flat tax of RM20,000. Every year a Labuan trading company must elect the method of taxation.

Other tax exemptions

Under the Malaysian Income Tax Act 1967 (ITA), the following are exempted from income tax:

Withholding tax exemption for payments of dividends, interests, technical fees and royalties made by a

Labuan company to non-residents or another Labuan company

- - Dividends paid by a Labuan company out of income derived from a Labuan business activity or out of exempt income. Such dividends will be paid gross without any tax

- - Interest paid by a Labuan company to a non-resident, resident or another Labuan company

- - Royalties paid by a Labuan company to a non-resident or another Labuan company

- - Technical or management fees paid by a Labuan company to a non-resident or to another Labuan company

- - 100% tax exemption on fees paid to a non-citizen Director of a Labuan company

- - 50% tax exemption on salary paid to a foreigner employed by a Labuan company

Double Taxation Agreements (DTAs)

Labuan companies benefit from Malaysia's double taxation agreements (DTAs), which can minimise withholding and capital gains

Malaysia has approximately 69 DTAs with countries across Asia, Europe, Africa and the Middle East

For a full list of countries, see http://www.hasil.gov.my/

It should be noted, however, that certain DTAs do not apply to Labuan. Specific advice should be sought prior to applying for DTA benefits for tax treaties.

In light of greater global competition, the government announced during the 2008 budget that a Labuan company given the option to be taxed under the ITA is irrevocable.

With this option, upon an unchangeable election to be taxed under the ITA, a Labuan company would gain access to all of Malaysia's double taxation agreements.

Stamp Duty Exemption

Under the Stamp Duty (Exemption) (No. 3) Order 2012, the following are exempt from stamp duty:

- - all instruments which are executed by a Labuan entity in connection with a Labuan business activity,

- - all Memorandum and Articles of Association, statute, charter, rules, by-laws, partnership agreement or other instrument, under or by which a Labuan entity is established, and

- - all instruments of transfer of shares in a Labuan

EURASIA is a global leader in high-value business services to clients operating and investing globally.

EURASIA is a global leader in high-value business services to clients operating and investing globally.